The FIRE phenomenon has recently resurfaced in the media. We’ve discussed it before, but FIRE stands for financial independence/retire early. The concept seems to spin the heads of those in the media and 90% of readers who respond in the comment sections below articles.

For the refresher, it’s figuring out what you can live on, knocking down the expenses to that level, then saving the appropriate amount that will generate enough to cover said expenses. If you can live on $30,000, you’ll probably need $700,000 returning 4.5% per annum to cover your needs. Getting to the $700,000 (or more) is the hard part. Many of those who’ve done it have had six figure incomes and they’re out of the work force in their 30’s or 40’s.

Inevitably anyone who has pulled themselves off the beaten path is going to attract criticism and skepticism from those who are ploughing the well-trod lane. Jealously? Maybe, or just a sign of financial illiteracy in the general community. There is a point where accumulated wealth can very helpfully generate further wealth, be that for further accumulation or income.

No one has to retire at 35 or 40, but the principles behind FIRE aren’t some form of black magic finance. It’s nothing more than saving and investing.

Saving works. It’s undeniable. If someone starts putting $150 in a bank account each week, this time next year there will be $7800 in that bank account, plus maybe $90 in interest. Invest it and get 6% per annum and you’ll have $218. Maybe the earnings will buy dinner for two in the first year. Almost seems inconsequential to bother with, you can already buy dinner yourself. What’s the point?

Repetitive actions add up.

Investing works too. Repeat that action for another ten years with a portfolio achieving a 6% pa return and you’ve got $120,000. Up to this point the savings have done most of the lifting, but after 11 years anything better than a 6% return will surpass the yearly amount saved. After 17 years the yearly returns double the yearly contribution.

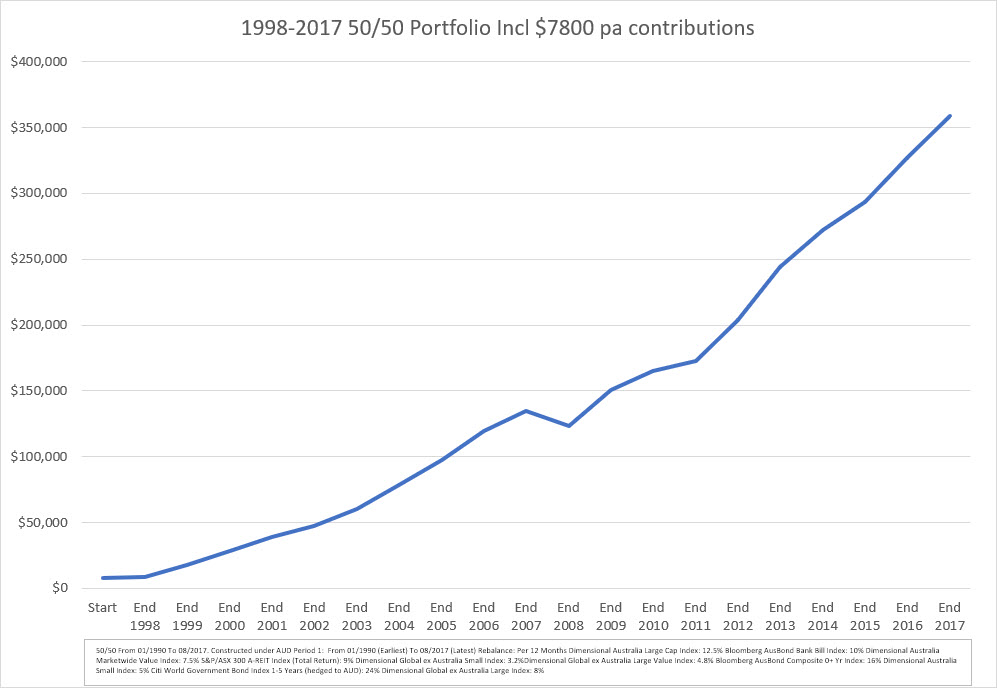

By 20 years in, at 6% per annum, the portfolio value is $326,000. Over half of it is now returns. And from this point on returns will be doing all the heavy lifting. Let’s step over to the real-world example of this. This past 20 years with a 50/50 portfolio, actual per annum return? 7.74%. Let’s assume you’ve got a year of saving $150 a week under your belt and are ready to invest.

Portfolio value? $358,931. Sure, you now have to worry about corrections adversely impacting your wealth more than before. A 2.2% portfolio correction will now decrease the portfolio more than is being saved in a year, but at this point, should that really be the focus?

That portfolio and what the savings have done will have the ability to dictate life choices.

“Well what the hell!” the 22 year old says. “All those savings are like 3 Ford Rangers or 20 trips to Thailand. If I’m not going to spend it now? What does it buy in the future?”

Time.

You’ve bought your future self the opportunity to make decisions that you otherwise couldn’t have. This Is the real FIRE philosophy.

Advocates against saving have always used all manner of guilt tactics. Living in the moment, the focus on treating themselves with ongoing luxuries, as if time itself wasn’t a luxury. Or the trite “well you never know what’s going to happen tomorrow” excuse. If something is going to happen tomorrow, that’s what insurance is for.

While people often focus on the unfair or unlucky accidents and illnesses of others to justify taking a particular action, it’s also a way to set aside another uncomfortable idea. Absolutely nothing may happen tomorrow. Another brutal reality of life for the non-saver might be that not much of consequence happens. Day to day eventually becomes year to year and decade to decade. Naturally, it won’t happen in perpetuity, but longevity risk is just as real as the belief of short termism.

Wait a decade to come to this conclusion and catching up takes much more effort. The returns may not always be as good as the examples, but you can’t control those anyway. You can control your behaviour and your behaviour today unquestionably decides your tomorrow.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.