Christmas is the time of year when shopping cranks up, people wind down and financial markets exist in a mostly positive slumber. You don’t expect much bad to occur in financial markets during December.

For the most part, over the last 30-something years, December has been the month where you’d receive a little extra in your Christmas stocking. The average return for the ASX 300 accumulation index in December since 1980 is 2.07%, with only 10 negative months in total throughout the time period.

Not this past December.

While returns weren’t that bad in December 2018, down less than half a percent on the ASX, it was the capitulation point for a lengthy correction that started earlier in the quarter and nearly turned into a bear market. For much of the month, December didn’t appear like it was going to offer much respite, the ASX was on an almost consistent downward trajectory, until nearly three weeks in. Then things abruptly turned and rallied, before giving up some of those gains before the end of the month.

As we know now, that was setting the stage for a recovery. Three weeks into January 2019 and the ASX had bounced 7% from December’s lows. What we also know now about December 2018, is that in the US it was an extremely high month for outflows as a monetary value. In particular, actively managed funds saw large outflows (no surprise). If you’re not sure what outflows are, think a lot of investors selling out.

According to data from Morningstar out Thursday, actively managed mutual funds experienced outflows of nearly $143 billion in December, their worst month ever. The record exodus brought the yearly outflows to $301 billion, just shy of 2016’s $320 billion.

“December outflows spanned asset classes, with taxable-bond funds faring worst. [Active] large-growth and large-value funds continue to get hit the hardest, likely losing assets to passively managed, core large-blend funds,” Morningstar senior analyst Kevin McDevitt said in a note on Thursday.

While we don’t have the data for Australia, it’s not a stretch to imagine similar behaviour occurring here, given our market followed a similar path to the US over the final quarter of 2018. Eventually some investors let their emotions get the best of them, believe there will be more bad times to come and sell out.

As you’ll note, these record outflows didn’t happen in October or November when prices were higher, and investors could have walked away with more money in their pockets. They happened in December, after consistent declines and patience really being tested. These investors were making the old mistake of selling out at the bottom, only to watch the market rebound.

This isn’t a new phenomenon. Often there will be large outflows around market bottoms. Why do investors do this? Emotion. Relentless declines become too much. The last time the market wasn’t going down is months behind in the rear-view mirror and investors can only imagine more falls ahead.

Our old friends in the media play a part in helping investors believe there is only bad ahead. When the market is going upwards or sideways, you’ll rarely, if ever, see the sharemarket lead the nightly news, make the front page or crawl to the top story on a news website. Get a big daily sell off or have a correction and those stories immediately jump to lead the news. Reporters will then be casting around for opinions and generally the opinions you get during a correction will be “expect more of the same.”

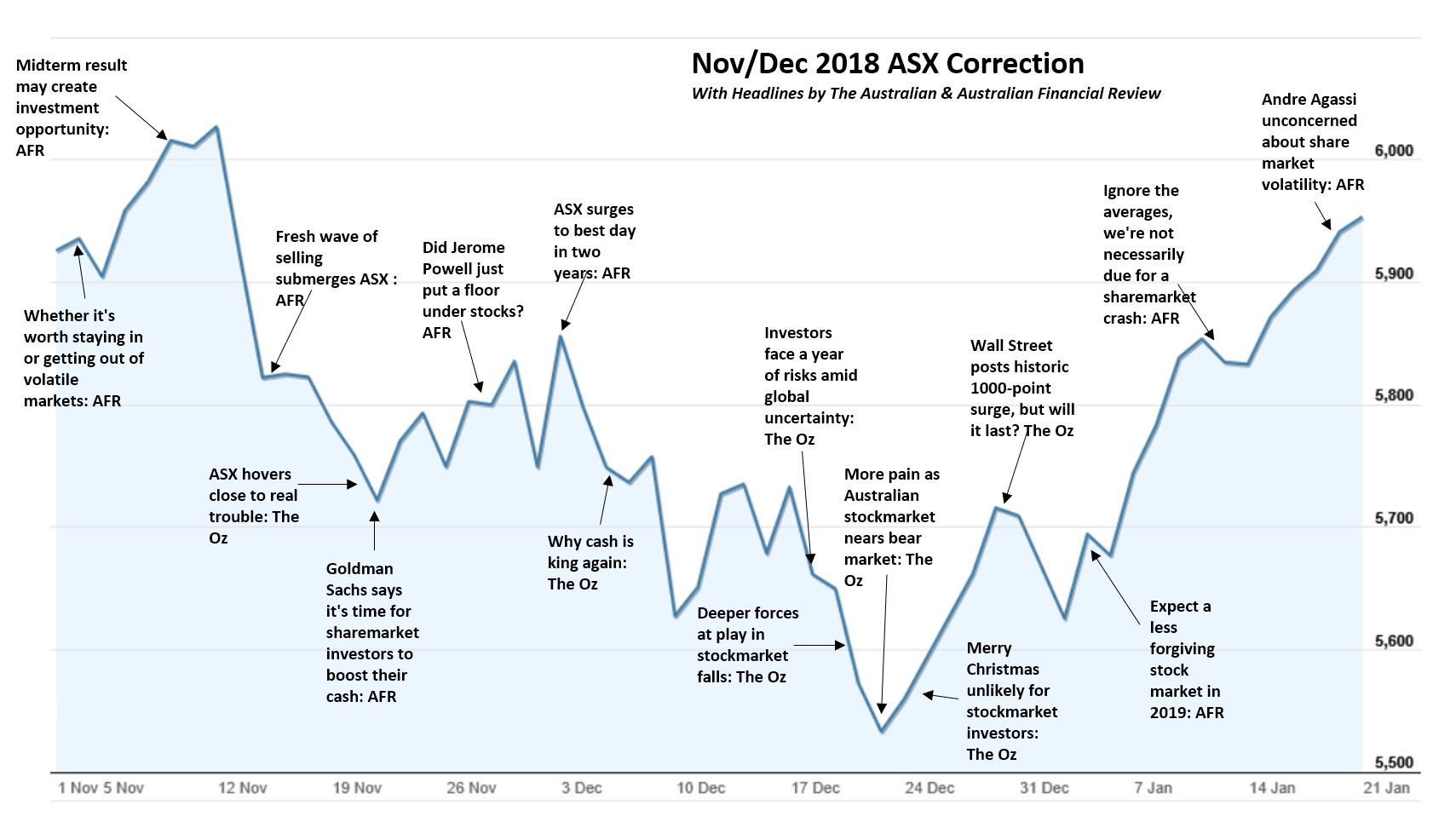

The tail end of the recent correction provided a good opportunity to view news headlines in the context of where the market was at that moment. So we put together a chart of the ASX all ords overlayed with headlines from two of Australia’s most prominent newspapers – The Australian and The Australian Financial Review.

In hindsight, you can quickly see how the media, and those they give column space, to rarely have anything valuable to say in the moment. In fact, they run with headlines that look comical in retrospect given what the market chooses to do next. Many of the headlines will just be variants of themes the media have run with during previous corrections or sell offs.

Note the old favourite of going to cash is mentioned twice after significant falls. The call that someone or something (in this case US Fed Chair Jerome Powell) may have put a floor under markets. Not quite because the All Ords fell another 4.5% from that point. Then there’s the old chestnuts talking about ‘uncertainty’ and ‘deeper forces at play’.

Finally, the last two headlines are most noteworthy, the storm looks to be over so it’s time to cast around for a little bit of wisdom. Starting with we’re ‘not necessarily due for a sharemarket crash’ (they are exceedingly rare) and how tennis player Andre Agassi is unconcerned about the volatility. Something that might seem funny, but Agassi runs a charitable foundation that relies on market returns to help fund its work. He says the fund is well diversified, so he’s not concerned about the market ups and downs.

Next time there’s a correction, instead of quoting a fund manager making predictions or suggestions about what investors should do next, maybe the media should seek out Mr Agassi’s opinion.

Corrections happen. Remain calm and remain diversified. Game, set & match, Mr Agassi.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.